Darren and I spend 10% of our income on retirement savings. It’s a sacrifice for us to invest that much and really ought to be 15%. We are working towards that eventually, but it’s not easy with as many kids as we are providing for at our level of income.

Roth IRAs grow tax free. When you make less than $9,000 a year (like a kid might) you are in the 10% tax bracket. They pay the measly tax and can invest with no taxes on the interest income. That means if they retire as multi-millionaires and live off their Roth they won’t pay income tax during retirement. It’s a beautiful system.

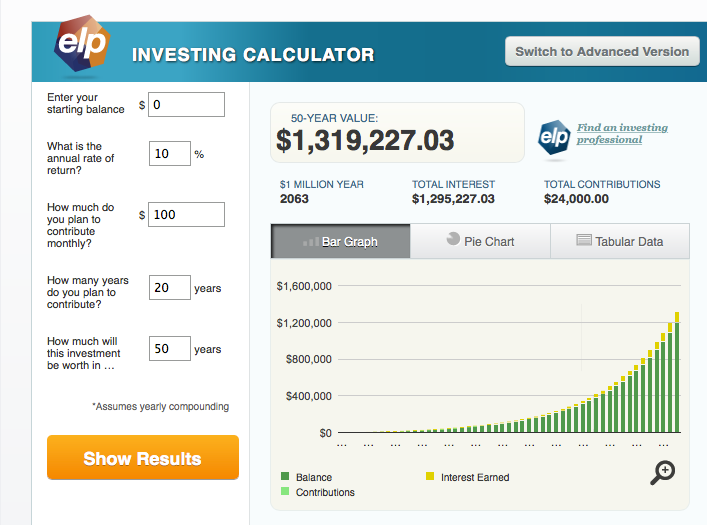

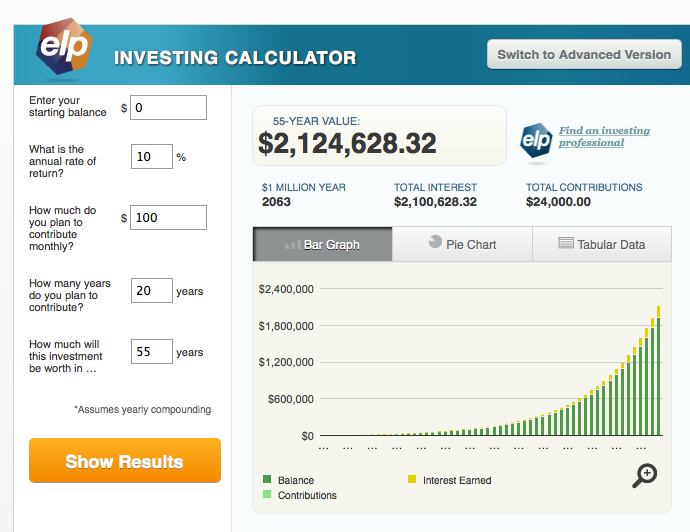

Let me explain what’s going on in this graphic. A 10 year old kid starts working mowing lawns. He invests $1200 a year into his Roth IRA. (That’s $100 a month.) He does it for 20 years, never increasing his payment and when he’s 30 he stops investing completely. By the time he’s 60 years old, he will have 1.3 million dollars to retire on. If he waits 5 more years until he’s 65, he’ll have 2.1 million. Adding just $50 a month increases this to 3.1 million. During the time he’s raising his children, he’d never need to invest again and would still have a sweet nest egg for retirement.

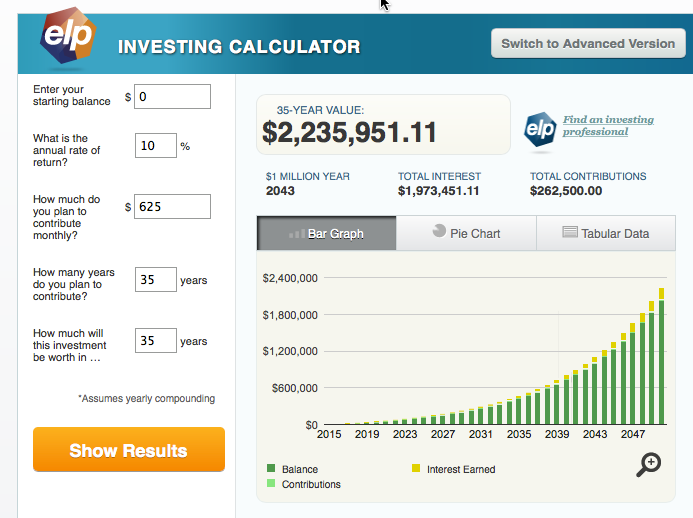

Compare that with someone who starts investing at 25. He makes $50,000 a year and invests 15% or $7,500 a year, $625 a month. He invests for 35 years until he’s 60 years old. At that point his investment is worth $2.2 million. The 10 year old kid who earned almost that much

, only invested $24,000 of his own money to get there. The 25 year old had to invest $262,500 to get there. Starting YOUNG is huge.

It’s really fun to plug different numbers and scenarios into the retirement calculator. Start the conversation with your kids and let them play around with the numbers here.

This is day 10 of our series 31 Days of Kids and Money

Need help picking investments? Check this out.

Isn’t it super fun to plug numbers into stuff like that?! It makes me giddy. LOL #imanerd

YES! I like numbers a lot, lol. I made several other charts, but didn’t include them, because it was pretty nerdy. I did show them to my husband who got as excited about it as I did.

What are your thoughts on this investing plus saving for college? I know college isn’t always necessary but so far my older children all want to be doctors or veterinarians. These require traditional college and then some. But I can’t ever find recommendations on saving for both.

Investing 15% of your income in your own retirement is priority. The kids investing in theirs is 2nd, except they should not do 15%, $100 or $150 a month is good. They can only start a ROTH if they have earned income, so first step is to earn some money. Their leftovers can be budgeted to invest in college, saving for a vehicle, and a bit for fun. My kids are doing the A+ program that pays 100% for their first 2 years of community college. They are also taking full advantage of college credit offered through AP High School Classes. AND they are working hard to keep their grades up and being involved in the community so other scholarships will be available. We hope they earn full rides, but are doing what we can to prepare for the chance we have to pay out of pocket. If you want to invest for them in college (which I recommend) do it after you are already investing in your own retirement.