Yesterday I asked you to think about how you would spend $100 if that was all you had to feed your family for the month. I’ve never lived on such a small budget for our family. Even when we were getting out of debt and had 3 small children (instead of 6 big ones) our budget was $185. That’s as low as I’ve ever gone. There are a bunch of great ideas in the comments and several people even mentioned giving it a try for a month. Report back if you do, but understand I’m not asking or even suggesting someone try it. It’s just a mental exercise.

Here’s a list of the highest nutrition lowest cost foods I know. Some of them have been smeared online as unhealthy foods (ahem…..whole wheat, cough cough….potatoes), but since the dawn of creation they have sustained healthy human life. If God made it and called it good for food, it’s good enough for me. None of these links are affiliate links. Links are for proof of price. There may be lower cost options available locally. Unlinked foods are from Aldi.

1. Whole Wheat Berries: $15.48 for 25 lbs; 274 servings at $.05 each. I would grind them fresh for pancakes, whole wheat bread, English muffins, tortillas, pitas, cracked forhot breakfast cereal, sprout it for salads etc. It would be our main diet staple.

2. Long Grain Brown Rice: 5 lbs for $3.38; 50 servings at $.07 each. I would use it to make rice, pilaf, soup, pudding, hot breakfast cereal, and yes–sprouts.

3. Dry Pinto Beans: 4 lbs for $3.82; 52 servings at $.07 each. I would use these in soup, casseroles, with rice, veggie burgers, ground as flour to add protein to bread, and grow sprouts etc.

- Rolled Oats (Aldi): 42 oz for $2.39; 30 servings $.08 each. I would make hot breakfast cereal; add it to bread, muffins, pancakes etc.

- Popping Corn: 2 lb for $1.98; 27 servings at $.07 each. I would pop this for snacks and grind it for cornbread and hot cereal mush.

6. Celery: 1 stalk for $1; 16 servings for $.06 each. Soups, salads; with peanut butter. The beauty of this food is you can regrow it from the base.

7. Potatoes: 10 lbs for $2.99; 20 servings for $.15 each; baked potatoes, soups, home fries; mashed potatoes, bread.

8. Carrots: 2 lbs for $1; 8 servings for $.12 each; salads; soups; muffins, pancakes;

9. Eggs: $1.59 a dozen; 8 servings for $.20 each

10. Milk: $2.15 a gallon; 16 servings for $.13 each. I would use it in pancakes; hot cereal; biscuits; and yogurt making

11. Peanut Butter: 40 oz for $2.99; 35 servings for $.09 each. Sandwiches, muffins, and as a dip for veggies and fruit

12. Apples: 3 lbs for $2.69; 9 servings for $.29 each

13. Bananas: 4 lb for $1.16; 16 servings for $.07 each

14. Onions: 3 lb for $1.99; 12 servings for $.16; add to soups and casseroles to add flavor and nutrition

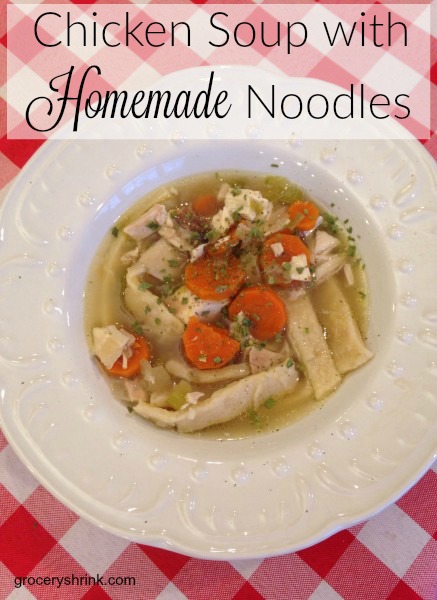

15. Whole Chickens: 5 lbs for $4.75; 16 servings for $.29 each. I would boil chicken for bone broth soup and remove the meat to combine with beans, rice, etc…and make it stretch.

Everything on this list totals $49.36 and has 589 servings averaging $.08 each. (Keep in mind it takes several servings of different foods to make a balanced meal.) I still have half my budget left to do this again or find a little more variety to add to the mix. While I was shopping and doing the research for this post, they had chicken legs on sale for $.49 a lb; oranges 4 lb for $3; broccoli for $1 a lb and avocados for $.39 each.

In March, I could add nutrition by gathering wild edibles like lamb’s quarter, clover blossom and leaves; violets; wild chives; and dandelion. Hunting for more protein options is another possibility. There are also 30+ harvester drop off locations in driving distance from my house where we could get free food several times a week. Area grocery stores donate product to them for a tax deduction when they get close to their sale date. Most of these drop offs do not ask for registration or proof of income, but do require some wait time to stand in line.

When I made my purchases I would also think about what could regrow into food for the future. For example, celery and green onions can be regrown from the base. Potatoes can be cut into pieces and planted in the spring. Right now is the time to start seeds from peppers, tomatoes, and cantaloupe. You can grow them from seeds found inside your purchased food. Here’s more info on growing a garden from grocery store food and here.

What do you think? Did any of the cost per servings surprise you?

I’m a big fan of Chip and Joanna Gaines. So big that I paid $10 on Amazon to watch Season 2 of Fixer Upper after I saw Season 1 three times. During the third round of season 1 Darren said, “Haven’t we seen this one before?” I just smiled and handed him some popcorn. Season 2 didn’t disappoint. Chip had me screaming, laughing, and cringing and Joanna made me want to appreciate my kids a little bit more.

I’m a big fan of Chip and Joanna Gaines. So big that I paid $10 on Amazon to watch Season 2 of Fixer Upper after I saw Season 1 three times. During the third round of season 1 Darren said, “Haven’t we seen this one before?” I just smiled and handed him some popcorn. Season 2 didn’t disappoint. Chip had me screaming, laughing, and cringing and Joanna made me want to appreciate my kids a little bit more.

The average family of 8 spends between $1200-$1600 a month on food. We spend $620 ($550 for groceries, $40 for eating out and $30 for lunch allowance for my husband.) A difference of $580-$980 a month. That means over a year we are saving $6,960-$11,760. We have been living this way for more than 10 years for a cumulative savings of $69,600-$117,600. Around here, that’s enough to pay cash for a modest house.

The average family of 8 spends between $1200-$1600 a month on food. We spend $620 ($550 for groceries, $40 for eating out and $30 for lunch allowance for my husband.) A difference of $580-$980 a month. That means over a year we are saving $6,960-$11,760. We have been living this way for more than 10 years for a cumulative savings of $69,600-$117,600. Around here, that’s enough to pay cash for a modest house.