But first, I want you to know that I’m visiting at Stacy Makes Cents today. Come along and find out the secrets behind my crazy low grocery budget. After you leave a comment on this post of course :).

A child might be a clothing snob if:

- They reject second hand clothing

- They determine the quality of an item by it’s name brand

- They determine the quality of an item by it’s price

- They beg for clothing the family can’t afford

- They have a closet full of clothes (that fit) and nothing to wear

- They think sales are embarrassing

- They think once a style is sold at insert any store here, it’s outdated

- They would never shop at insert any store here

- They judge another person’s value by what they wear

The thing about clothing snobs is they have low self worth. They don’t believe they are anyone special apart from their clothing and that’s the main issue to combat. Making them feel guilty about the naked kids in Africa won’t do it, though that can be a project once self-worth is restored. They might have caught the wrong message of worth from a bully, an advertisement, or a TV show. However it happened doesn’t matter, the important thing is to make sure they recognize their own value (and also the value of others.)

They are of worth because God made them in His image. He loved them so much that he gave them their free will. Then left his throne to die in their place in hopes that they might use their free will to choose Him. No piece of clothing can change their worth.

As you are building a proper view of self, there are other things you can do.

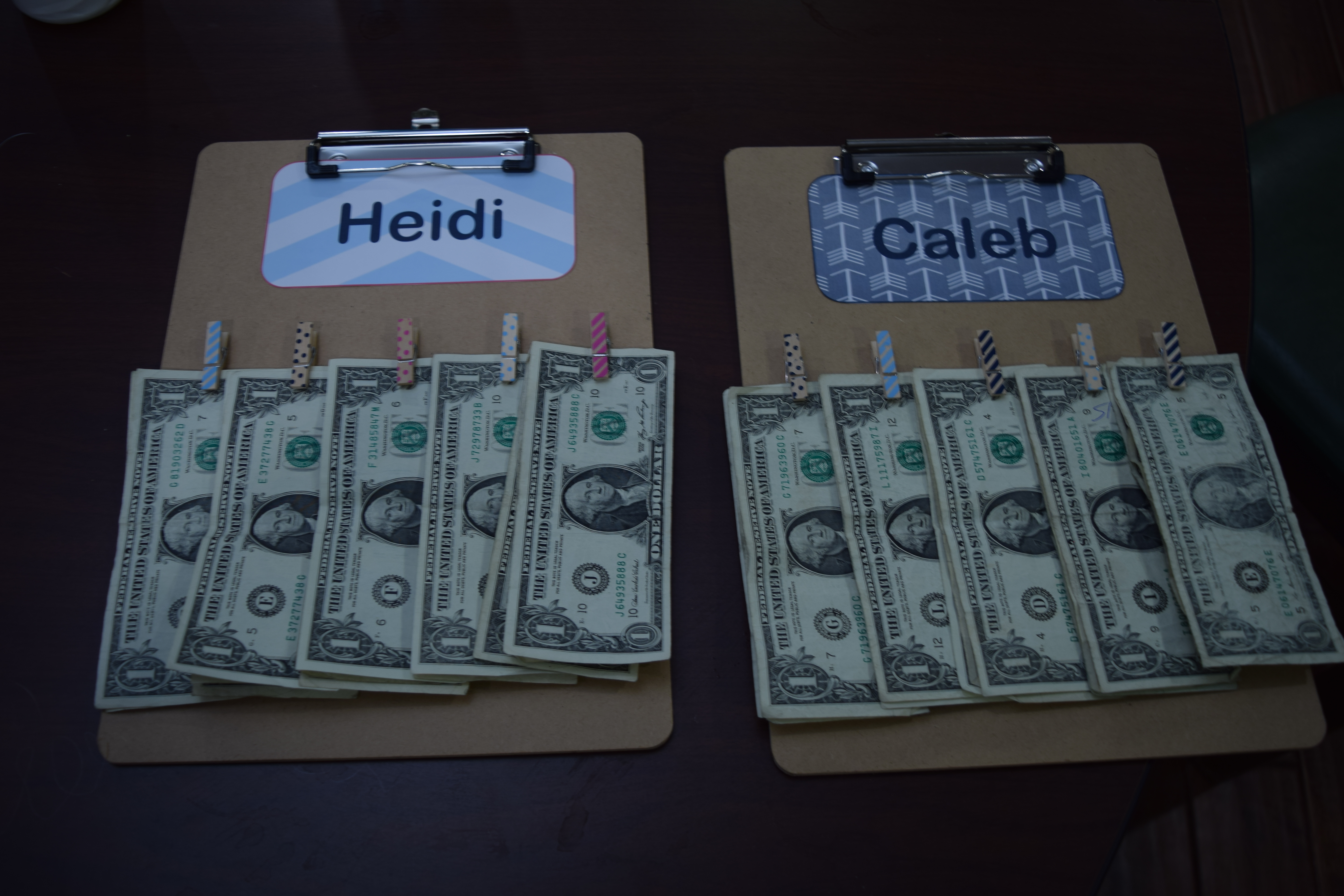

- Try giving them their own clothing envelope and let them use it to buy their own clothes. For this to work, you can NOT bail them out. If they spend it all, they’ll need to earn the money on their own to meet their clothing needs.

- Donate their excess clothing to a good cause. Such as the dress project or a local ministry.

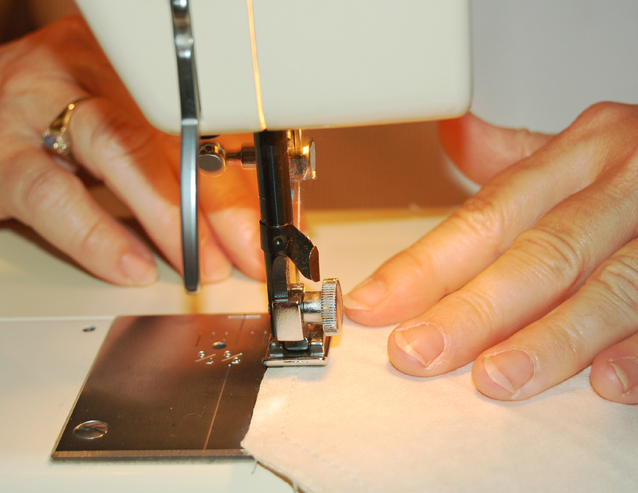

- Sew dresses for little dresses for Africa. Or for babies born sleeping. Or knit hats and scarves for the homeless and here.

There’s something about volunteering and serving that heals the soul.

This is day 21 of our series 31 Days of Kids and Money