Several factors can affect the way you budget your household. This is why we wrote the article ‘How to Get Your Husband to Budget With You’. When it comes to narrowing down household expenses, two heads are better than one. Now, let’s take a closer look at another potential budget plan destroyer: hidden expenses.

Acquiring the Latest Technology

This may seem glaringly obvious, but you don’t really need that new smartphone. Unless you need to acquire the latest version of a phone, computer processor, digital camera, or graphics card for your job or career, there’s really no real reason for you to get it. Don’t get caught in the hype and social pressure of always having the latest gadget. It’s likely to be an expense that you don’t really need, and there will be cheaper versions on the market.

Succumbing to “Good Deals”

It’s good to take advantage of discounts, but don’t let mall and outlet store sale events fool you. Mall department stores are notorious for marking up items and then selling them at “discounted” prices. Again, avoiding the hidden expense here is important. Bustle state that there’s no need to buy items that you normally wouldn’t buy just because they’re “on sale.”

Overpriced Coffee

It’s no secret that franchise and boutique coffee shops overcharge for coffee. If your office or workplace has a kitchen or similar facilities, just brew your own. The money that you spend on quality brews at coffee shops translate to more than twice the amount of a home or office-brewed coffee of similar quality. Additionally, the more you brew your own, the better you’ll eventually be at picking the right beans and brewing them correctly. The only thing better than saving money is acquiring a new skill while you’re at it.

Hidden Bills and Taxes

Hidden bills and taxes are some of the most frustrating ways to spend money, and this is more of a problem than most people realize. For example, if you buy a property in a city like New York, you might be surprised to find that the title costs are unexpectedly high. Check the paperwork and you’ll likely see that the most expensive item on your title bill is something that’s called mortgage recording tax.

Here’s what you need to know about this semi-hidden bill that can cause frustration to homeowners trying to budget their expenses. It’s a percentage of the new mortgage debt amount and is generally paid by whoever buys the property. The city-imposed tax applies to all new mortgages, and is due when the mortgage is recorded. Unless you’re buying a co-op unit, you’ll need to factor in the cost of your mortgage recording tax early on. Otherwise, you might fall short of your original budget and find yourself having to dig deeper into your savings. The lesson here is to always read the small print.

Another notorious source of hidden bills are hotels that list hidden charges on your final bill. This is commonly done via “drip pricing,” which the Federal Trade Commission explains is when hotels only reveal prices as the buying process proceeds. This means being charged for things like valet parking, pool maintenance, exercise facilities, or other privileges even though you haven’t technically benefited from them. So before you book any hostel, motel, resort, or hotel, be absolutely clear about what you need to pay. And if they still charge you erroneously, feel free to contest the bill.

Avoiding any and all hidden expenses is a matter of being informed and assertive about your own financial rights. Always do your homework whenever you’re planning to spend a significant amount of money or even just a little.

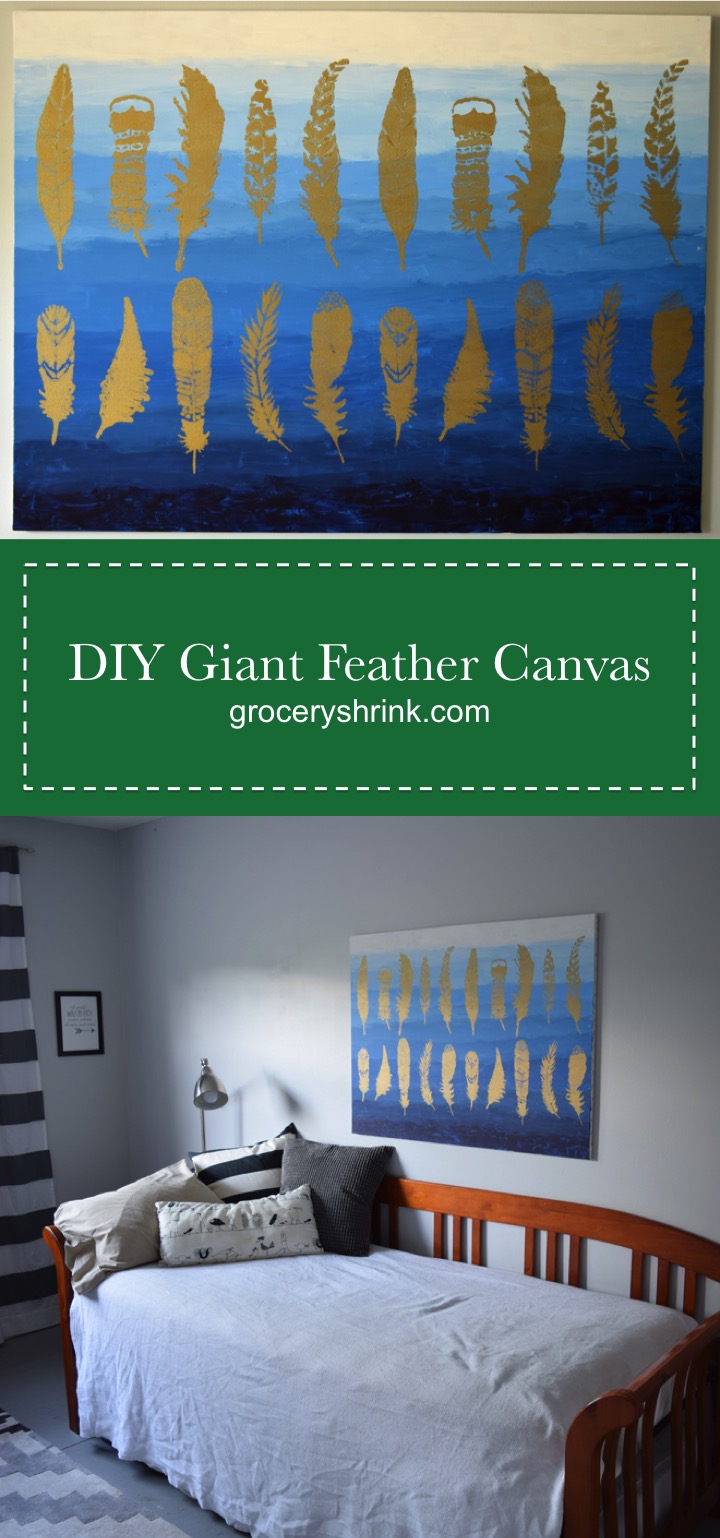

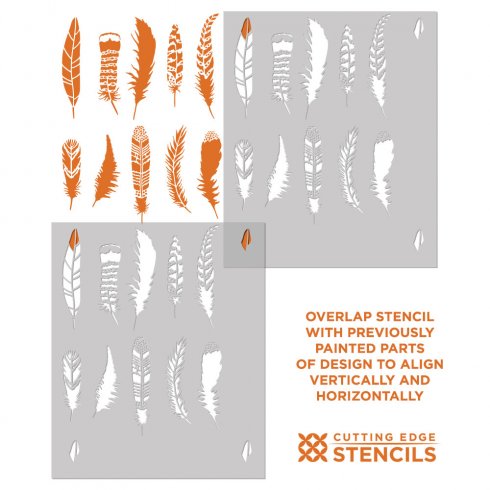

A gigantic white canvas scares me. It is full of possiblities but begs me to choose just one.

A gigantic white canvas scares me. It is full of possiblities but begs me to choose just one.

Mix month is still going strong and I have a big line up for you next week! But for the weekend I wanted to show you some progress I’m making in the girl’s bathroom. In July, I’ll have a whole month of house projects and frugal nesting ideas for you–this is just a sneak peek :).

Mix month is still going strong and I have a big line up for you next week! But for the weekend I wanted to show you some progress I’m making in the girl’s bathroom. In July, I’ll have a whole month of house projects and frugal nesting ideas for you–this is just a sneak peek :).