Our washing machine died yesterday and it isn’t an emergency. The Fisher and Paykel washer was 11 years old and after 3 loads a day (roughly 12,000 loads), we knew it’s days were numbered. Planning for this didn’t start last week, or even a few years ago. It started the day we bought it. After we became debt free with a fully funded emergency fund, we added some other budget categories to prepare for days like today. Every month, we set aside $10-30 in an “appliance fund” and since we know ourselves and needed extra accountability, the cash went into a real envelope and tucked into a combination safe (not into the bank account where we pay for other bills.) We also fund other bonus budget categories including a car replacement fund and furniture replacement fund. We set aside small amounts each month into these envelopes so that over the period of 10-15 years we can replace our items that wear out.

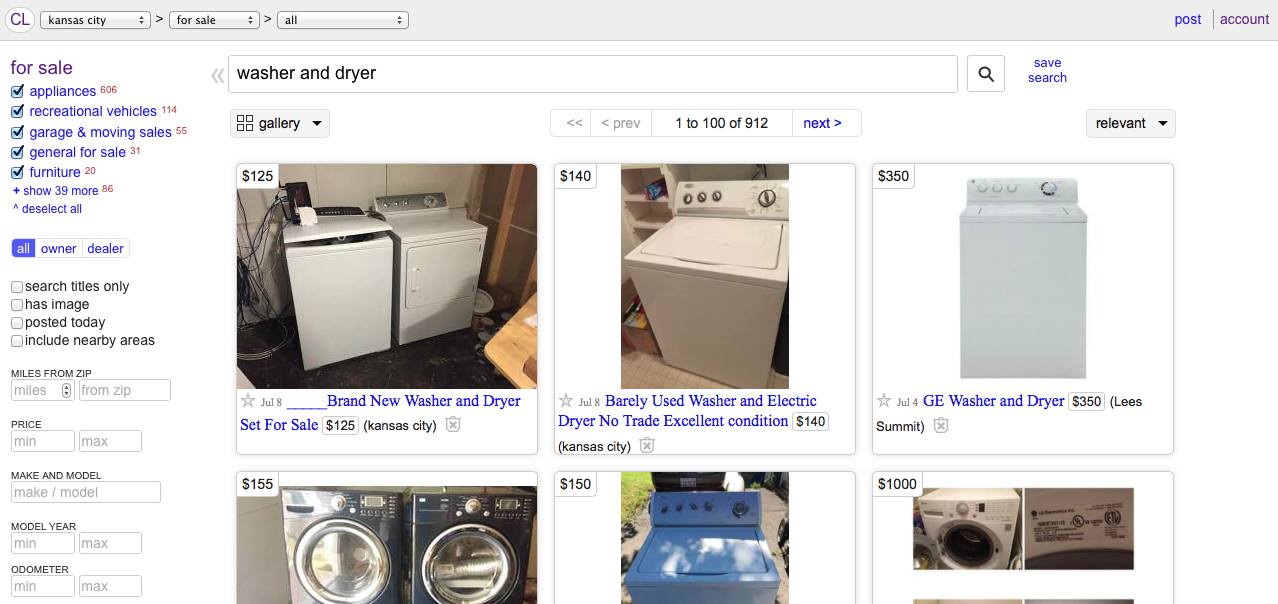

If I hadn’t had an appliance replacement fund, my day yesterday would have looked very different. I would have searched our local Craigslist for a working washing machine to limp by with until we could raise the money we needed. They had used machines about the age of ours ranging from $50-$150. I would have used part of our emergency fund or my home repair fund, to pay cash for the appliance. It’s not a bad plan really and if there hadn’t have been any good sales on, I might have done that anyway so we could wait for a better deal.

Instead, I had the cash to shop for the best rated machines I could afford. I looked at reviews online, drove to the scratch and dent outlet store to see their choices, and thanked my lucky stars that Independence Day sales were still going strong.

When it came time to make my final decision, I almost went with my less favorite, just to save a few hundred dollars. Then Darren reminded me that this machine should last us 15 years or more and that since we had the cash saved up, I should buy the set of machines that I wanted to use for the next 15 years.

Even though our dryer is still working, it is almost 18 years old. We decided to buy a matched set since the machines are visible from most of the main floor. I should be able to sell the working dryer on Craigslist to offset our costs a little.

I chose the Whirlpool Cabrio set because of it’s huge capacity, low resource use, and good reviews. I loved the idea of a front loader and would love to be able to build a counter over the top of my machines, but the whole mildew thing and needing to leave the door open discouraged me.

After searching the prices online of all the stores that carry this model of machine, We called Sears to order over the phone. I needed the dryer door reversed and that couldn’t be specified online. While I was on the phone the operator asked me if I had a coupon code I would like to use. I said, “oh! Is there one?” He put me on hold and we both searched for any available coupon codes. I was unable to find a coupon code that would work in their system, but his manager approved an additional 5% discount for us. The cool thing about this, is the 5% discount is the same we would have earned by using a sears credit card. As a rule, we don’t use credit cards and I was feeling kind of bad about missing the discount. Turns out, I didn’t have to miss it after all.

It may seem like a lot of extra little categories, but most people won’t miss the extra $10-$30 a month and over 15 years that fund will grow to be $1800-$5400.