In October, I did something crazy and drove by myself to Dallas, TX where I had rented an apartment for a week with a complete stranger, Nicole Rule. She turned out to be my life line and kept me from getting lost in the big city. Nicole is a Mom of 4 adorable kids and writes at Greatest Worth about living intentionally, starting with money.

In October, I did something crazy and drove by myself to Dallas, TX where I had rented an apartment for a week with a complete stranger, Nicole Rule. She turned out to be my life line and kept me from getting lost in the big city. Nicole is a Mom of 4 adorable kids and writes at Greatest Worth about living intentionally, starting with money.

Today she’s going to share with us how she keeps her grocery budget down.

Here’s Nicole:

Hello!

I’m so grateful to Angela for giving me the opportunity to share how my family has managed our budget – namely our grocery budget – over the past 8 years.

First, a little context (after all, back-story is always fun): we paid off $100,000 in debt in 26 months and learned to live with purpose and from our values in the process. Of course, during that time we had to figure out how to cut spending so that we could put more money towards what we wanted. And, what we wanted most at that time, was to pay off our debt!

Fast forward to today and our household consists of four (growing) children ranging in age from three to nine years old and two active adults. This translates into needing a LOT of groceries to satisfy everyone. We needed to find some good strategies to cut our grocery bill. And fast.

According to USDA Cost of Food Plans our family of six should be able to survive on a monthly budget of $853.60. This is their “thrifty” plan.

I calculated this by taking their value for “Family of 4 with children ages 2-3 & 4-5” and adding it to the value for “Individual Child 6-8” and “Individual Child “9-11.”

They also provide numbers for “low cost,” “moderate cost” and “liberal” plans.

Our personal “low cost” monthly budget, according to USDA charts would be: $1114.20

Since we’re going for shrinking our grocery bills, I’m not going to go over the moderate and liberal plans.

Read the USDA fine print and you’ll see that these plans include all the food needed to prepare ALL snacks and ALL meals at home. While it isn’t likely that you’ll never go out to eat, I will say that our family rarely did during the time of our debt payoff. We had a mission, and that mission was more important to us than a trip to Chick-Fil-A or sushi!

You’ll have to decide what works for you and your family. If you’re convinced that you can’t go without a restaurant trip here or there, make another line item in your budget separate from your “Groceries” line item. Awareness is key to tackling debt, and awareness is built on honesty.

Our actual budget comes closest to the “low cost” monthly suggestion put out by the USDA. Right now, we hover around $1100 per month for our family of six. And, especially these past few months when we’ve been actively trying to spend less (since I started a new business and have a much lower income), we’ve actually stuck to it!

Here are some tips to help you do the same!

- What is your WHY?

First and foremost, what is your “why” for wanting to cut your grocery bills? Do you want to work less hours and stay home with your kids so you’re trying to figure out ways to cut your budget? Do you want to make space in your finances so you can take a dream vacation? Are you trying to put some money into college funds for your kids?

Figure out your why and the rest of this will feel like a fun game instead of a horrible chore.

1. Shop through your freezer and fridge first.

1. Shop through your freezer and fridge first.

I like to take a look at what I currently have in the fridge and freezer BEFORE I make a menu.

According to the EPA, a typical family of four in the US wastes about $1600 annually on produce alone! That’s a significant cut in your grocery budget right there! If you could save $1600 on groceries that would give you $1600 more for debt reduction, college savings or for that dream vacation you’re drooling over.

Seriously, look in your fridge and base some meals off of produce and protein that’s ready to be used.

Also, I buy meat in bulk (often directly from a farmer which is cheaper for much higher quality) and then freeze it. This step is crucial to me cutting down on my monthly budget. If I check the freezer and base all of my meals off of meat that I have on hand, my costs are cut dramatically. I’m sure I save hundreds, maybe a thousand or two a year on this trick alone.

2. Create a menu. (Or purchase Angela’s monthly menu plans – it’s a steal and the work is done for you!)

This is the part that usually trips people up.

Make a menu? I don’t have time for that.

So, if time is an issue you have a couple of choices.

1) purchase Angela’s ready made menu plans. It’s a giant value for what you get and there are even options for specific diets, such as gluten free. OR,

2) after the kids are in bed, make a glass of tea and DON’T scroll through your Facebook feed, and DON’T turn on “This is Us” (OH how I love that show!).

Instead get settled in for menu creation! You’re going to use this next hour to search Pinterest, or your favorite cookbook for some inspiration on what you’d like to make that week!

The first step in menu creation, is to be realistic about your week. If your kids have after school activities on Tuesday and Thursday next week, don’t plan on making a roast chicken dinner. Find a couple crock pot meals that set you up for success and have dinner done for you by the time everyone gets home! Or, use your Instant Pot to get meals done in an hour. We’ll sometimes cook something the night before in our Instant Pot and just reheat when it comes to dinner time!

Next, look at that list of meat and produce that you already have in your fridge – because you did step 3, right?! Base a couple of meals off of what you have on hand.

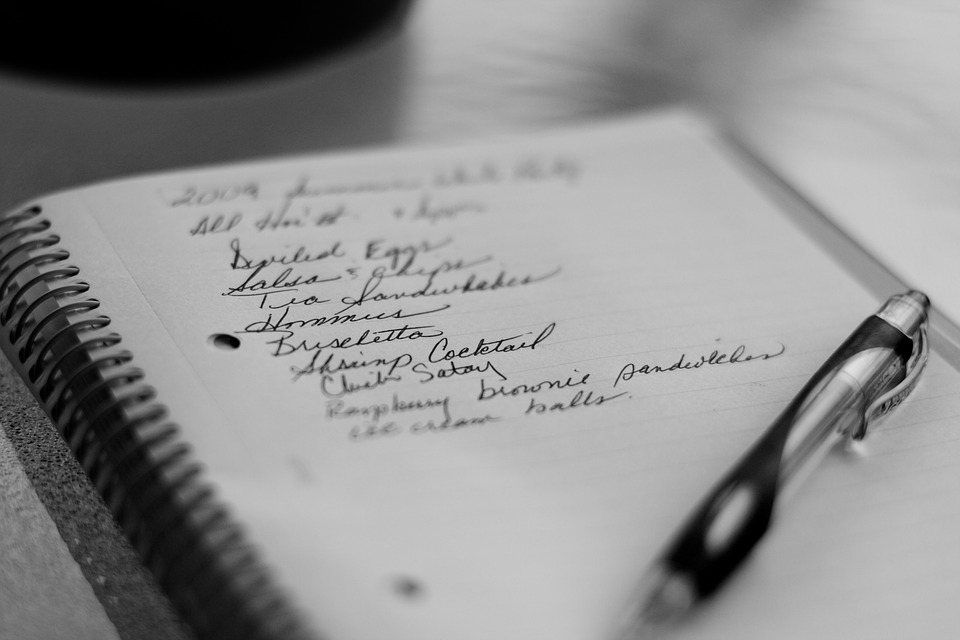

- Create a grocery list based on that menu.

As you’re going through and creating a menu, write down the ingredients you’ll need for each meal to make it a success. (We’re trying to only go to the grocery store once per week. It’s crucial to stay out of that store to avoid impulse buying – here’s an article on how grocery stores are designed to get us all to impulse buy!)

Write down everything that’s in the recipe and then move on to the next recipe. Don’t worry about whether you have the stuff needed or not right now. There’s nothing worse than getting up and down twenty times while you’re trying to plan out a menu! We’ll address that in the next step!

Side note: We really only plan our dinners so strictly, but remember you’ve got kids’ lunches to pack (maybe even lunches for you and your partner) and breakfasts to make. Think if there’s anything specific that you want to make for those meals and add it to your grocery list.

We have a “staples” grocery list. Things that we always need on hand to make breakfast and lunch go smoothly. Take the time to create one of those lists and you’ll never be caught saying, “shoot, I forgot the milk!” again!

- Shop at home first.

This goes back to number two, but instead of just focusing on perishables, rummage through your shelves and cabinets and closets. Take your grocery list with you and check off what you find.

You know that feeling when you get home from the grocery and you’re putting stuff away and then you see it. Dang. You already had cottage cheese and mustard and milk and onions. You overspent and you’re likely to have some of this go bad. Double dang.

This step has revolutionized my shopping budget. I am one of those, “I’ll just get another jar so we’ll always have mayo on hand” kind of girls. It can be ridiculous when I put the third jar of mayo up on the shelf. Let’s do it differently together.

- ALDI or Lidl or Anything from this List

Find the store in your area that is offering groceries at a deep discount. It will be a time and money saver. I used to shop at FOUR different grocery stores just to get the best prices. I wasn’t taking into account my time and what that’s worth.

For us that store is ALDI. I’ve started going to ALDI first, and cutting about 1.5 hours off my grocery shopping time! The trick is being willing to go to more than one store. Often ALDI does not carry everything on my list. But, for the discounts, I’m willing to manage that!

Their selection of fresh produce has gotten so much bigger and better. And their organic selection is also growing. I found organic cage free eggs there last time I went. Awesome sauce.

So, I shop at ALDI first!

- Shop your local farmer’s market.

I also make a little separate list for those items that I know my farmers will have. This produce is SO much tastier, fresher and healthier than the store’s counterpart. It’s also equally, if not more affordable – when compared to Whole Foods, or, even our regional chain’s produce.

Even if ALDI has organic carrots available, but I know my farmer will have organic carrots – I buy them from the farmer. The food is SO. Much. Better. So much better, in fact, my children ask for the carrots regularly as a snack!

They do NOT do this with ALDI carrots.

Enough said.

- Have potluck dinner parties.

Especially if community is one of your family values. These dinners are a great way to build community while on a budget.

Since hosting dinner parties can get a bit pricy, potlucks are an easy way to share the burden. Especially if you’re trying to build this into your weekly grocery budget.

Invite friends over. Make a big soup – an ancient, economical way to feed a large group of people. Have your friends bring salad and bread. Dinner is served and you’re not out double your dinner budget!

That’s it! Those are my tips for how to cut your grocery bill right now. I know some may feel a bit time consuming (creating a menu, anyone?) and I know that it never seems easy to start something new. But, you have a choice.

You can see this moment in your life, with this calling to change your relationship to money, as an opportunity to find creative, inspiring new strategies, or as a burden and chore. It’s that simple – a choice.

If you haven’t done so already, spend some time exploring and working through my “Defining Your Values Workbook.” What is important in your life? What action steps are going to get you closer to your long term goals?

It may seem like I’m being dramatic. How can defining my values and goals lead me to creating a menu? And how will all of this get me moving towards my long term goals?

I’m living proof that it can.

I believe it’s all the little things we do throughout the day that make up our lives. And those little things, if strategic and moving us towards what we want more of in life, will lead to a more authentic and fulfilling life.

I wanted to pay off my debt so that I could have freedom to follow creativity and inspiration. So that I could be home with my kids during their little people stage.

So I could have the freedom to choose the life I wanted, not resent the life I was given!

Defining my “Why,” creating a weekly menu, cutting my grocery spending have ALL played into my realization of those goals.

What is your big picture reason for cutting your grocery bills?

Write it down, and put it on your fridge. Keep this dream active and alive so you can feel it in your bones. Keep that bigger picture in your mind so that when you’re tempted to throw the menu out the window because you just don’t have time this week, you’ll remember. And you’ll MAKE time to create the menu one. More. Time.

Because that’s all we can do friends. Take it one day at a time.

Thanks for letting me share with you all today. If you’re interested in “Defining Your Values” or learning more about me and my mission to guide women to live intentionally, starting with their finances you can visit me at greatestworth.com! Come by and say hi. I can’t wait to meet you!

Also, click here if you’re interested in my FREE Budgeting Tips Printable that has even more tips on how we’ve saved thousands on groceries over the past 8 years!