Allowance vs Commissions….it doesn’t matter at our house, because either way you look at it, the money comes from the family budget. When your budget is super tight, that’s not an option.

Just so we’re talking about the same things:

- Allowance is money kids get for living. They are usually paid by the week or the month and use that to practice money management. Kids with allowances are usually expected to pay for their own entertainment, school lunches and sometimes clothing too.

- Commission is an allowance tied to performance. Kids earn their commissions by doing all their chores and having good behavior. It’s usually a set amount similar to an allowance, but they might not get it all if their performance isn’t up to par.

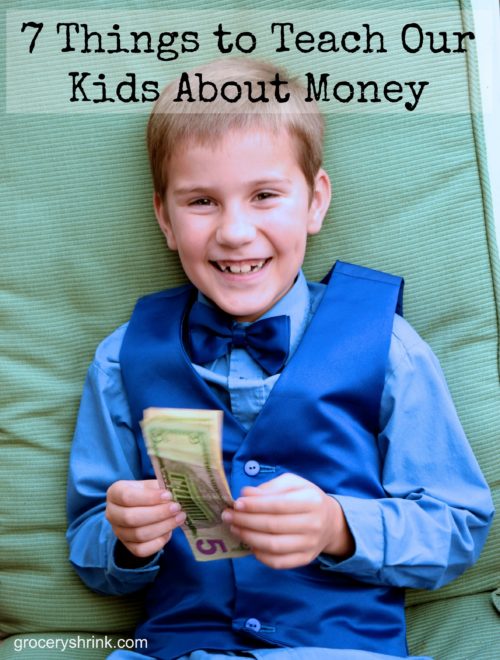

My kids get neither. We pay one child $1 a week for trash and another $3 to mow our yard. Occasionally I offer a quarter here and there to do some of the harder chores that are above and beyond their normal job description. Split that however you like between 6 kids and they don’t have enough money to learn how to manage it well. If they drop a quarter in the plate at church, it took a lot of work to earn that.

If I have a job that I would have hired an adult to do (because I had the budget for it) and one of my children could do that job, I offer it do them. I treat it like a job interview and if they act lazy or less than thrilled I don’t hire them and offer it to someone else. Those types of jobs don’t come up a lot, so our kids have remained relatively broke (though are usually enthusiastic about an opportunity.)

I want my kids to know how to handle money. To know how, they have to practice. In order to practice, they actually need money. It either has to come from me, or someone else.

3. We aren’t into begging people to pay our kids for things they wouldn’t normally pay for, so we taught them marketable skills and sent them out to the real world to bring in money apart from our family budget. So far it is working. Its harder on us while none of them are drivers, because we have to taxi them to their work. The hassle is worth it.

Next week I’m going to interview each one and let them tell you about their businesses (or future plans for one) and all the details. It’s going to be fun, because you never know what kids are going to say.

Do your kids get an allowance or commission? How do you teach them money management?

This is day 3 of our series: 31 days of Kids and Money

to buy inexpensive authentic Bahamian dinners at the Fish Fry Shacks.

to buy inexpensive authentic Bahamian dinners at the Fish Fry Shacks.

Oooooooh, I’m so excited! One Pot Wonders are deliciously easy meals that

Oooooooh, I’m so excited! One Pot Wonders are deliciously easy meals that