Say the word “homemaker,” and this is the most frequent response:

“What do you do all day?”

This question is offensive to a lot of at homemakers because it implies that there’s not enough to do to keep an at home spouse off the couch watching Netflix and eating raw cookie dough. (Not that that NEVER happens. Overwhelm can drive anyone to a Netflix cookie dough binge. And if there’s any job that’s overwhelming, it’s homemaking.)

I thought about it a lot and I think I can put my job description into one tidy sentence.

“I optimize life for my household.”

Cleaning is part of it, but a tiny part.

I make sure my husband can work, and try to take care of the things that would normally interrupt the working day of a spouse in a two income household. Things like making appointments, a sick child, meeting a service provider, running errands.

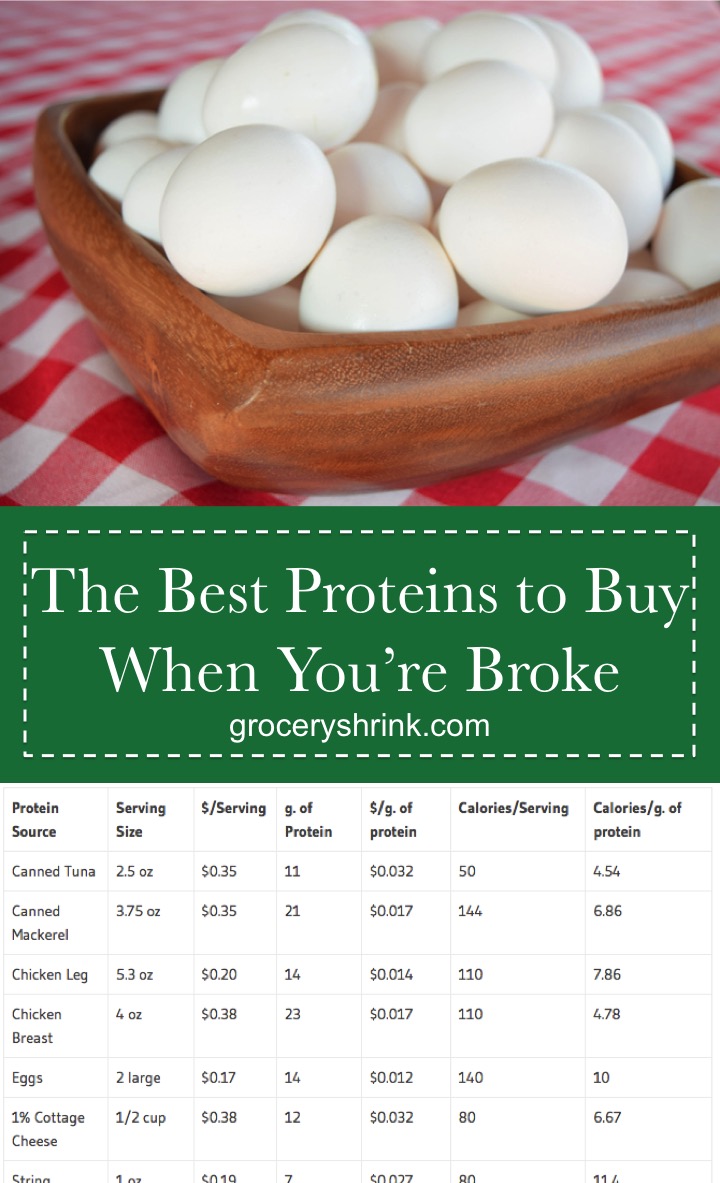

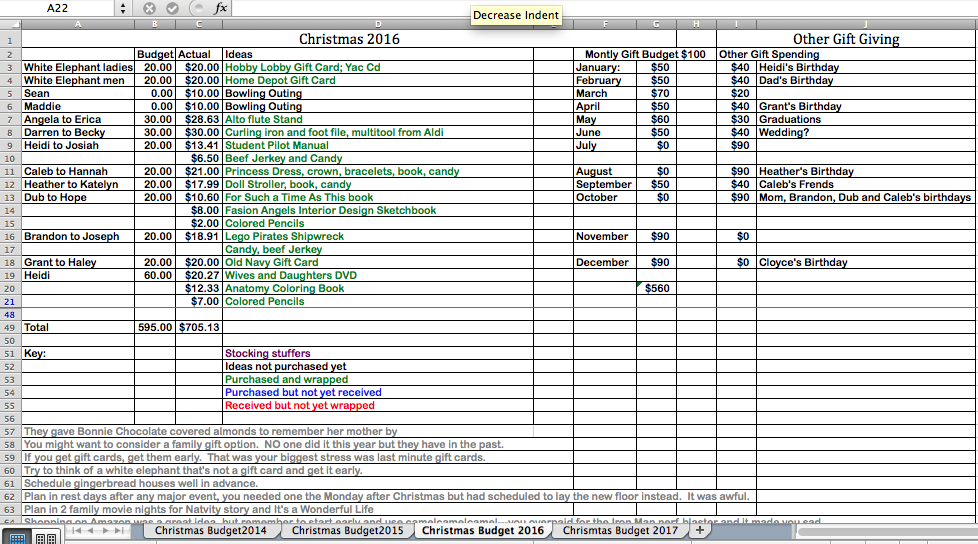

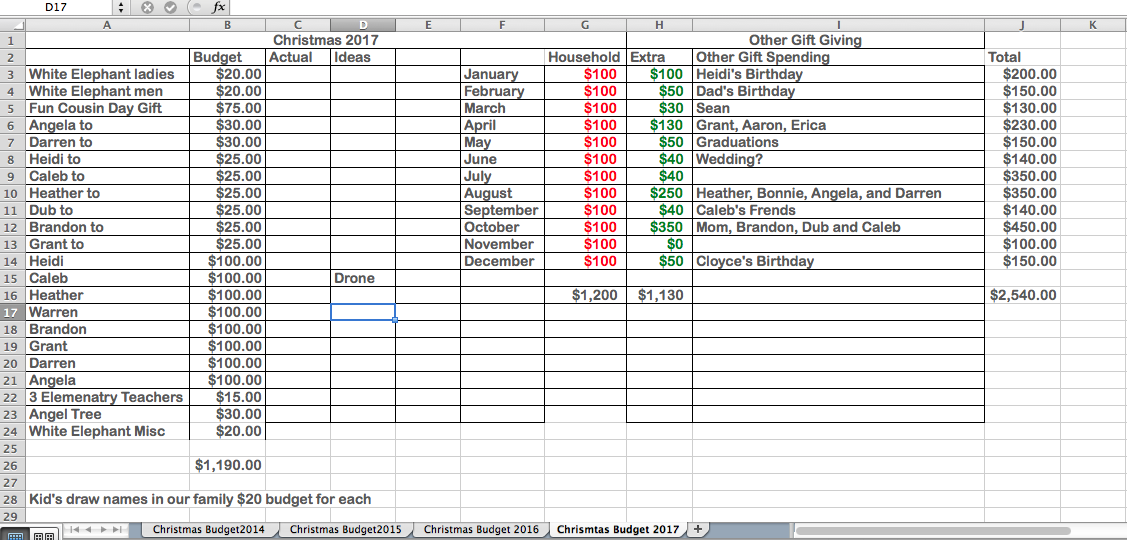

I research, research, research, so we get the right products, get appropriate discounts, and stay under budget.

It’s my job to keep food in the house, and prepare meals that are conducive to health, the budget and shared family time.

I learn new skills so we can hire out less. Skills like minor electrical work, carpentry, sewing, painting, interior design, and cooking.

I advocate for our kids, so their health and learning needs are not passed over. This means more research, a lot of research, and sometimes doing interventions myself when there aren’t professionals available to us.

I manage our stuff so we aren’t buried in a pile of it, and can still find what we need when we need it. That includes turning our used stuff into cash through garage sales, Craigslist, Ebay and tax deductible donations.

I make sure everyone has clothing, within budget, that fits, is clean and repaired. Sometimes that means making it myself, shopping online, or visiting several stores. Plus taking care of personal appearances like cutting a boy’s hair or guiding a daughter through makeup and hair for her first date.

I give encouragement and support so everyone can be their best selves. This includes helping with music practice and homework, listening to their joys and sorrows and stories, and reminding them how great God made them.

I am a full time dedicated cheer leader for 7 people. That’s my FAVORITE part of the job.

This doesn’t mean I do everything myself. I’m like a general contractor. I delegate the appropriate jobs. Sometimes I delegate jobs to my kids that would be easier to do myself, just because it’s good for them to work.

I take my job super seriously. I’m constantly researching the best ways to do things and learning new skills. I’m also human and with a job list as long as mine, the big size of our household, and our limited budget, my house isn’t always company ready and the laundry isn’t always folded and put away. Sometimes my time is better spent painting a room than keeping up with daily chores and I’m so thankful my family pitches in and is understanding about that.

It’s true that we sacrifice a little in available cash for me to have this position, but we gain so much more in quality of life in exchange. I know not everyone can make this choice, so trust me that I don’t stand in judgement of work out of the home moms. I was once that mom myself.

What do you think?

Before school started this fall, we made our kids a terrible, misguided, poorly thought out deal. We told them if they all made straight A’s at semester, we’d get a puppy. They have been begging for a dog for YEARS and finally we thought we’d consider it.

Before school started this fall, we made our kids a terrible, misguided, poorly thought out deal. We told them if they all made straight A’s at semester, we’d get a puppy. They have been begging for a dog for YEARS and finally we thought we’d consider it.